Managing your money can be challenging, but fortunately, there are a variety of budgeting tools available today that make it easier. No matter where your finances are, you can find simple tools to help you with your financial goals. Choose from free apps that sync with your bank accounts, AI-powered platforms that analyze your spending habits and more. You can also consider DIY approaches (like spreadsheets) or seek guidance from financial advisors for personalized plans. Most of these personal budgeting tools work right from your phone, so you can create budgets and check on them wherever you are.

Ready to get started? Let’s dive into some of the top financial planning and budgeting tools to help you make progress on your money-management goals.

A budgeting tool is a computer program or phone app that helps an individual or business plan, manage, monitor and modify their income and expenditure. Think of budgeting tools as your money managers. They’re designed to keep tabs on where your cash flows. These digital helpers can help track everything from your morning coffee runs to your monthly rent payments.

Here’s what makes a good budgeting tool worth using:

- They track your spending, showing exactly where your money goes.

- They nudge you toward savings goals.

- They do the boring stuff automatically (no more manual receipt tracking).

- They crunch numbers to show your spending patterns.

- They bend to fit your style, whether you’re frugal or a spendthrift.

- They link right to your bank accounts for real-time updates.

- They work for both simple budgets and complex money plans.

Mix the best free budgeting apps with paid ones that match your specific money goals for the best outcome. You’ll get the best of both worlds without breaking the bank.

If you’re looking to get your money sorted, here’s a quick overview of some of the online budgeting tools to consider:

- You Need A Budget (YNAB): This is our pick for an app overall. When it comes to goal-based budgeting, its zero-based budgeting system helps break the paycheck-to-paycheck cycle.

- Google Sheets: This is the best free option if you want to manually track and manage your finances without having to sign up for an additional service.

- Copilot Money: This contender is a top pick in AI-powered categorization. It has capabilities to help reduce the need for manual entries.

- Rocket Money: This app’s simple interface makes it the best option if you’re just getting started in the budgeting game.

- Monarch Money: If you’re looking for something that can sync all your existing bank accounts in one place for seamless financial health tracking. Monarch is a solid choice.

- Honeydue: This household budget tool is perfect for couples who want to track shared expenses while keeping some money matters private.

- Empower: This app is a top pick for tracking your financial investments.

Want to know more about any of these easy budgeting tools? Keep reading—we’ll break down how each one can help whip your finances into shape.

A solid budgeting tool needs to do more than just count your pennies. You want something that’s easy to use, plays nice with your bank accounts and doesn’t leave your financial data hanging out in the breeze.

Look for tools that:

- Connect seamlessly to your accounts.

- Let you customize categories and budgets.

- Keep your info locked down tight with bank-level security.

- Give you the real story about your money habits.

- Work across all your devices—desktop, phone, and tablet.

The best budgeting apps also send alerts when you’re about to blow your budget, or when suspicious charges pop up. After all, we all need a little heads-up before that next impulse buy wrecks our savings goals.

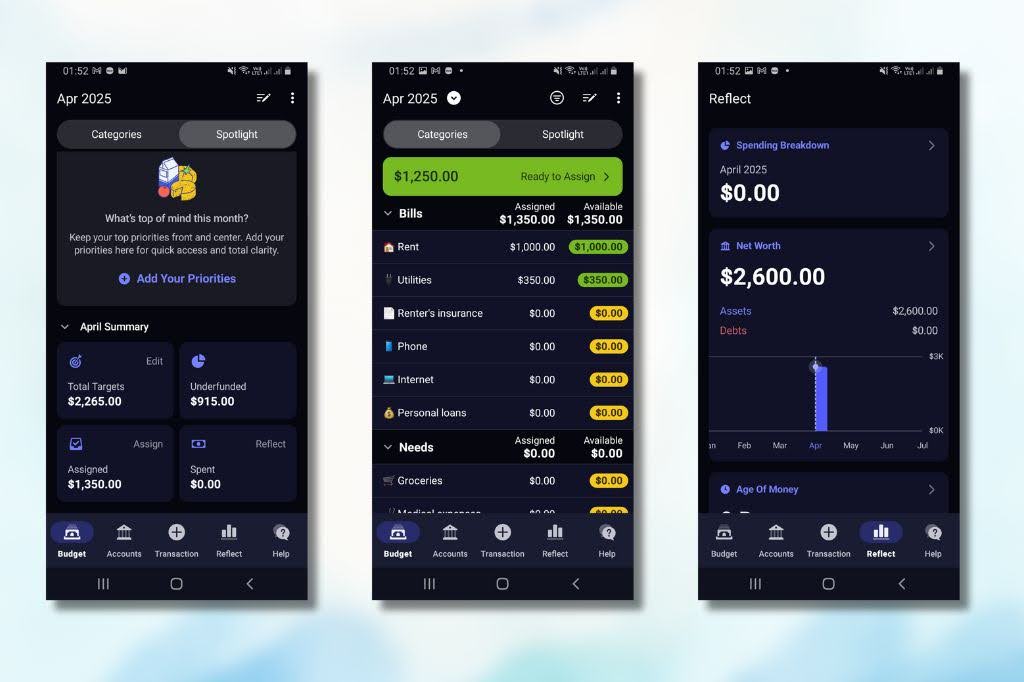

1. You Need A Budget (YNAB): Best Overall Budgeting App

YNAB stands out as a top choice for personal money management. This app follows a zero-based method, assigning every dollar to a specific bill or job, from groceries to savings goals. You’ll find powerful features like bank account syncing, detailed spending reports, and net worth tracking all wrapped in a mobile-friendly package.

The app comes with helpful workshops and allows up to five users to share accounts, making it a good option for households. Before forking out any of your money, you can take advantage of YNAB’s 34-day free trial offering. After that, it costs $14.99 monthly (or $109 yearly), and students get 12 months free. Keep in mind there’s a learning curve if you’re new to zero-based budgeting.

YNAB is rated as an Excellent Editor’s Choice pick from PC Mag, and CNET gives it props as a “real difference maker for your budgeting.” It also gets an average of 4.6 stars in reviews from users on TrustPilot.

2. Google Sheets: Best Free Budgeting Tool

Free budgeting tools can be helpful when your funds are tight. For budget-conscious money managers, Google Sheets tops the list of free options. This flexible spreadsheet tool comes loaded with free budget templates that you can adjust to fit your needs. You’ll get unlimited data input, custom formulas, and the ability to track every penny your way.

It takes more time to input expenses manually, but the trade-off is total control over your money tracking system. You can add charts, create multiple budgets, and share your sheets with family members. For those wanting automation, connecting Tiller lets you pull in bank data automatically, though that’s an extra cost.

The Motley Fool praises Google Sheets for its versatility when it comes to budgeting. It’s also rated as the best free budgeting tool according to CNBC.

Note: You can always use Microsoft Excel if you prefer the Microsoft ecosystem. The same applies if you use LibreOffice Calc.

3. Copilot Money: Best AI-Powered Budgeting Tool

Copilot Money is built to work exclusively on Apple devices, making it a great choice if you’re in the Apple ecosystem. It sorts your spending automatically and spots patterns you might miss on your own.

The app utilizes a personalized categorization engine called Copilot Intelligence. This AI feature monitors your financial patterns and uses this knowledge for future categorization of your transactions without the need for rule creation.

It watches your accounts, groups expenses, and gives you practical money tips based on your habits. While it’s Apple-only and costs $95 yearly (or $13 monthly), the time you’ll save on budget tracking might be worth the investment. It’s a great choice if you want to eliminate the hassle of manual tracking.

Copilot Money is a Webby Award Winner as well as an Apple Editor’s Choice Award Winner.

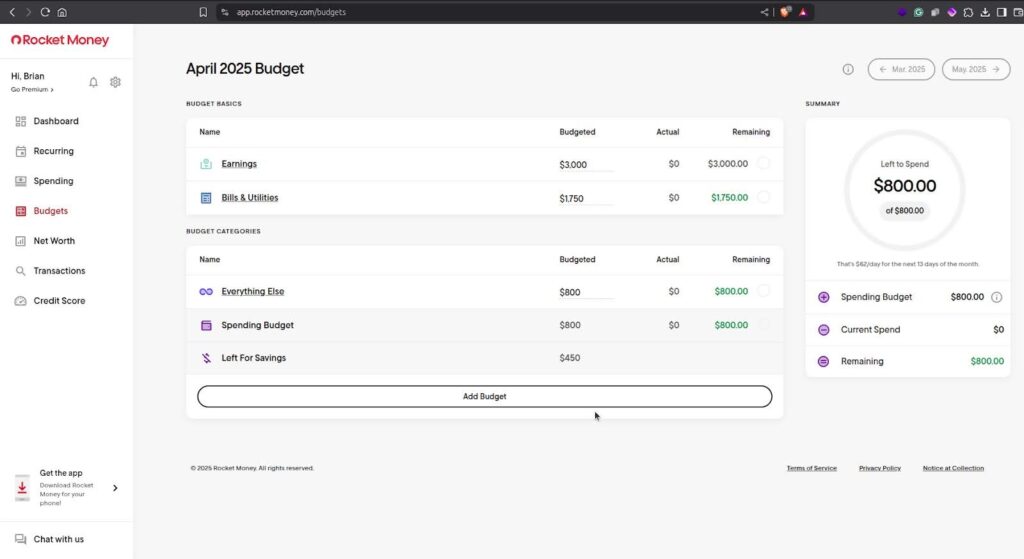

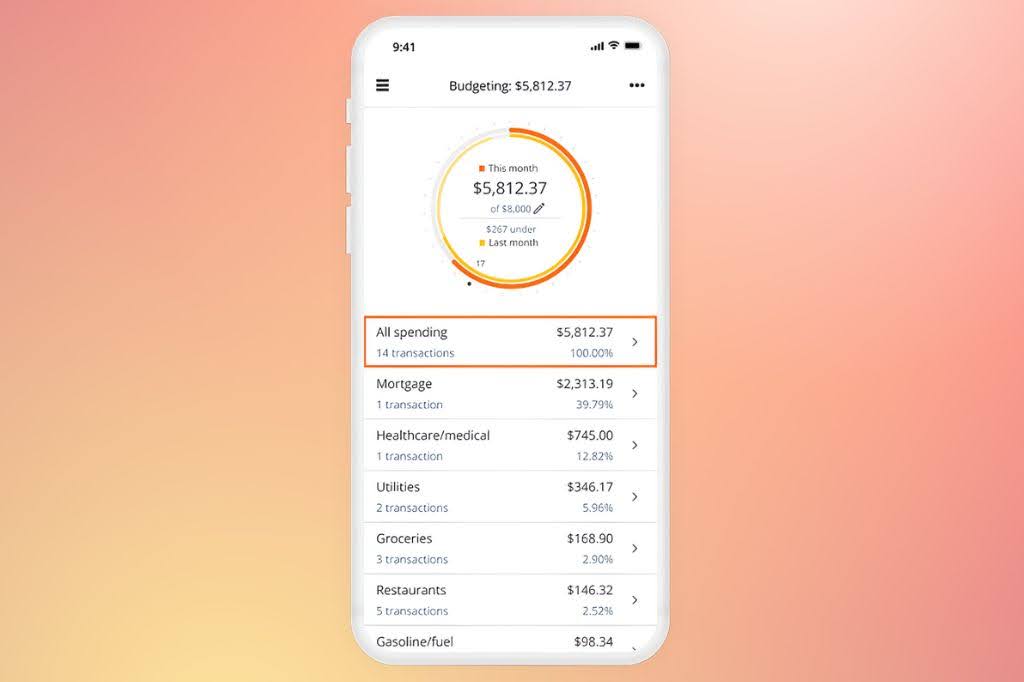

4. Rocket Money: Best for Beginners

Rocket Money takes a straightforward approach to money management. The free version lets you monitor your spending with automatic tracking, while the clean interface makes checking your finances feel second nature. The app also finds and helps you cut unwanted subscriptions.

Some handy features, like detailed reports, need a premium account ($6-$12 monthly), but the free tier gives you plenty to work with. It’s a solid choice if you’re just getting started with budgeting and want a no-fuss way to watch your money.

CNET gave Rocket Money its Editor’s Choice Award, praising the app for being user-friendly and having plenty of helpful features.

Related: How to Budget Your Money as a Teen

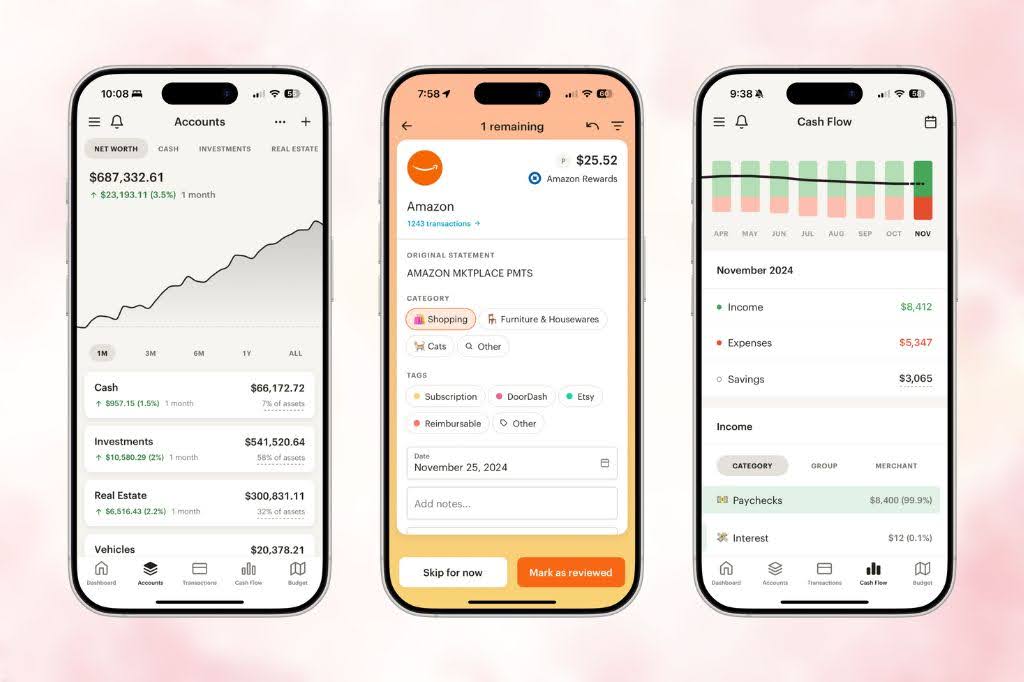

5. Monarch Money: Best for Families

Need to manage money with your whole household? Monarch Money makes family budgeting a team sport. Share accounts, set goals together, and keep tabs on your family’s total financial picture in one place.

The app lets everyone pitch in on money decisions while tracking shared expenses and savings targets. Each family member can check progress, add transactions, and work toward common goals. The built-in net worth tracker shows how your family’s finances grow over time.

At $14.99 monthly (or $99 yearly), it’s not the cheapest option. But for families who want to handle money as a unit, the collaborative features can make budget planning feel more like a group effort than a chore.

Monarch Money is a recipient of the Fintech Breakthrough Awards in the personal finance category.

6. Honeydue: Best Free Tool for Couples

Honeydue makes financial discussions easier by consolidating your and your partner’s finances in one place. This free app allows couples to track their spending side by side, with timely reminders about upcoming bills.

You can chat right in the app about specific purchases, set spending limits together, and get instant updates when your partner makes a transaction. The built-in bill reminder system helps make sure nothing slips through the cracks.

The basic features cover most couples’ needs, though you won’t find fancy investment tools or detailed analysis options. Yet for keeping your shared finances on track without spending a dime, Honeydue hits the sweet spot.

The Wall Street Journal credits Honeydue with being the best budgeting app for couples.

7. Empower: Best for Investing

Empower brings together everyday money management with smart investment tracking, and is a good fit for those who would like to keep tabs on their budget and investments. The app shows your complete financial picture, from bank accounts to retirement funds.

You’ll get handy tools like net worth tracking, a retirement planning calculator, and a broad view of all your investments. The investment checkup feature helps spot hidden fees and suggests ways to balance your portfolio.

The basic money tools are free, but you might notice some features try to point you toward their paid investment advice services. Still, for investors who want to link budgeting with portfolio management, the free version offers plenty of value.

Empower has received high marks from the NAPA Advisor’s Choice Awards, with praise for its personalized tools. It also received 4.5 stars from Forbes Advisor, noted as a next pick for tracking net worth.

How to Choose the Right Budgeting Tool for You

For the best possible financial outcome, you need to find a budgeting tool that matches your style and goals.

Think About What You Need

Start by asking yourself some of these questions:

- How much am I willing to spend monthly?

- Do I want automatic or manual tracking?

- Do I need investment tracking too?

- What devices will I use the app on?

- How detailed do I need my reports to be?

- Will I share this with family members?

Test Out a Few Budgeting Tools

Then, the key is taking a few of the best budgeting tools for a test drive. Most offer free trials, meaning you can play around without spending a dime. Try these steps:

- Download 2-3 apps that fit your budget.

- Connect one bank account (not every one!) to each.

- Use them for two weeks straight.

- Check which one you open daily.

- See which reports make sense to you.

Quick Tip: Keep in mind that even the most advanced budget management tools won’t help if you never open them. Pick something that feels natural to use, like checking your social media. The best household budget tool is the one you’ll actually use consistently.

Find the Right Personal Finance Tool for Budgeting Today

Money management today is less about crunching numbers and more about finding the right digital partner for your financial goals. Whether you’re team YNAB or crushing it with Google Sheets, the perfect budgeting tool is out there waiting for you.

Take a few apps for a spin, see which one makes your wallet feel special, and commit to the one that fits your financial style. These tools can help you save money and get your finances on track, so it’s a win all the way around.

This article was updated in June 2025. Photo by Dean fizkes/Shutterstock